Implementing a Prospecting Policy to Optimize Offers to Prospects Based on Lifetime Profitability

- Corridor Research

- Jul 22, 2021

- 4 min read

Updated: Oct 25, 2023

Business problem

A critical challenge in acquisition marketing is the need to frame a compelling offer to prospects that meets their requirement at the point-of-need, with offers terms that build long term profitability for the bank. More often than not, these optimizing prospecting decisions need to be made in a real-time digital setting with the flexibility around offer management against competing offers from other banks and Fintech's.

What is Corridor Platforms?

Corridor Platforms is a leading decision workflow governance and automation capability designed by industry veterans to rapidly transform risk and marketing decisioning at banks, enabling them to leverage new data, AI and automation to create competitive excellence in revenue growth, risk control and operating efficiency in the age of digitization. The platform offers full connectivity between data, features, models and strategies with systemic governance and control at every step in the decision lifecycle.

Prospecting campaign with optimized offers

In this use case, we will showcase the development of an end-to-end prospecting strategy on Corridor Platforms which leverages sophisticated lifetime value frameworks to optimize offers to prospects in real time with flexible offer management to effectively compete against competitive offers. The schematic diagram below shows how the Corridor driven prospecting strategies enables real time offer generation.

In the following section, we will cover the steps to set up a prospecting campaign on Corridor to generate optimized offers to prospects.

Step 1 – Setup the product to be offered to the prospect

Corridor has flexible capability to set up product types (or categories) such as credit cards, installment loans with configuration parameters defining the product type. Then, specific products can be instantiated from the product type. In the example below, ‘36month installment loan’ and a ‘platinum credit card’ are instantiated as the two potential products to be offered to prospects.

Step 2 – Setup the prospect estimated LTV (Life Time Value) framework

The policy writer can set up a sophisticated custom framework to calculate LTV of prospects. The framework takes a set of inputs (described below), a custom logic for calculation of LTV and outputs the estimated discounted cash flows which are then used in the valuation function to calculate the LTV for each offer configuration.

Inputs to LTV framework

Product parameters

Response model

Acceptance model

Acquisition cost

Cost of funds

Prospect data

LTV custom logic

Sample of the logic code is displayed below. While this is an illustration, the framework writer has strong flexibility to write powerful custom frameworks to be used in policies.

Output of the LTV framework

The framework logic outputs the estimated discounted cash flows of the prospect which are then used to calculate the LTV of the prospect through the Valuation Function. See screenshots below.

Net Cash flow

Acquisition cost

These outputs are then used to calculate the LTV and used by the policy for each prospect.

Step 3 – Setup a policy with strategies to optimize the offer to prospect

Prospecting policy setup: As the first step, register the prospecting policy through the prospecting module and set up the offer generator, the prospect LTV framework and models to be used for defining the optimization strategy. See screenshots below.

Offer generator setup

LTV Framework and model setup in the policy

Step 4- Develop a product selection offer strategy that maximizes prospect estimated value

Develop an optimization strategy which iterates in real-time offers with varying credit limits and rates for two offered products of Installment Loan 36 months (IL_36) and Platinum Credit Card (PL_CC) and selects a product that maximizes the estimated lifetime value of prospect with a constraint of rate ceiling.

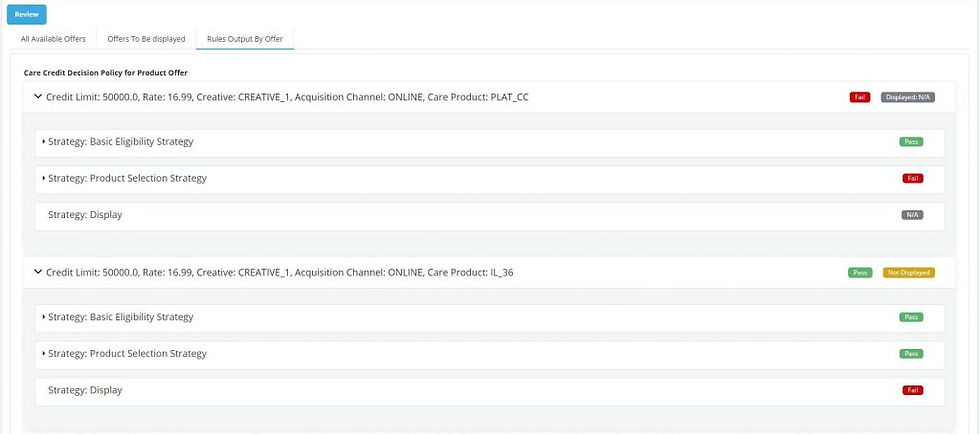

Step 5- Testing real time execution scenarios for product selection in offers

Running various scenarios of execution of the strategy for offer generation, for a $50,000 loan, the expected lifetime value of an installment loan is higher than a platinum credit card (factoring in the response and acceptance propensities of prospect) and hence the product offered is the IL_36 over the PL_CC.

Step 6- Offer display management when multiple offers qualify for the prospect

In scenarios where multiple offers can be offered to the prospect, Corridor has the capability to flexibly manage rank ordering of offers that should be presented to the client. In the context of this use case, we have configured the following scenario:

If prospect FICO => 750, show them one offer that has the highest LTV of prospect across range of offer amounts

If prospect FICO < 750, show them a max offer of $40,000 loan amount across the products (IL or CC), to maximize the revenue potential and focus less on maximizing LTV.

The offer display logic screenshot in shown below:

While this example is an illustration, highly custom display logic (by segments as required) can be configured in the offer display module to give the ultimate “segment-of-1” offer customization capability to the policy writer.

As an example run, for a prospect with FICO = 720, the above display configuration results in 1 final offer being presented to the prospect at $40,000 loan amount.

In addition, the display management logic can be enhanced to factor in external competitive offers and its impact on uptake rate for the banks offer, making the offer display logic dynamic to evolving competitive and market dynamics.

Step 7- Deployment of analytics to production quickly and continuously refinement over time

Once the analytics is built and approved through banks’ custom approval workflows on the platform, Corridor stitches together a standalone artifact which incorporates all the dependent models, features and data elements required to enable the analytics for the prospecting policy.

The artifact can then easily be called in batch or real time model flexibly by production deployment systems to enable the full use case. See schematic below for the overall process flow to stitch the artifact and extract for production deployment.

Conclusion

We have demonstrated the ease of rapidly building a sophisticated prospecting policy from scratch on Corridor, with flexibility of display management in-built into the analytics and the ability to quickly move analytics to production systems without the need to re-test or re-code and reduce the overall cycle time to market.

Comments